· Market on the Rise ·

Ripple Effect To Have Large Impact

Those who preach doom and gloom in the real estate market are doing so as a self-fulfilling prophecy, an excuse to explain why they are not doing the same volume of deals as they once were. Changing market conditions requires ones strategy to also evolve and change; you cannot expect to continue as the status quo in a market that is not the same. Vancouver’s real estate market is one that has drastically changed since the announcement of the foreign buyers tax. We have seen tightening of mortgage regulations, a crackdown on principle residency reporting and an overall decrease in sales; there are sections of the market however that are red hot and beginning to take off.

· Hot Market ·

In the past month we have experienced certain sections of the market to be extremely desirable and almost always resulting in multiple offer situations. Development properties, liveable homes under two million, and condos are currently flying off the shelves at an astounding rate.

Recently I was involved in a purchase of a liveable, but very dated home in Eagle Harbour of West Vancouver. This property needed a significant amount of work to bring it up to today’s standards and was over priced to be torn down; the play here was to renovate and live. After being told by the listing agent “we are not in a hot market, I do not expect to receive offers over list” the property received 9 offers and sold for $81,000 above the listing price. I had no doubts that this property would go over list and sell for the price it did, I did not however expect 9 offers.

The second deal that I was recently involved in was that of a development property, specifically a rezoning from duplex to four units. This was a project that required a large amount of capital, knowledge, time and skill; it was not one that your average Buyer could handle. This property received four offers and sold for $280,000 over list with a no-subject offer.

Finally, the third scenario that I was involved in last week was a multiple offer situation on a condo. The agent had first agreed to look at offers “as they come” only to renege on this plan after seeing the response at the public open house. This property received numerous offers and sold for a record-breaking price per square foot for the building.

The fact that these three sections of the market are so active begs the question, when will the ripple effect transfer to the rest of the market? Each time a sale takes place the owner of that home is displaced and must go somewhere else, usually upwards in the market. At this current time we are not seeing this natural progression; homes above two million are receiving far less interest than those priced below this benchmark. I believe that in a very short period of time sales will begin to pick up rapidly in these middle/higher end segments of the market purely due to the transfer of demand.

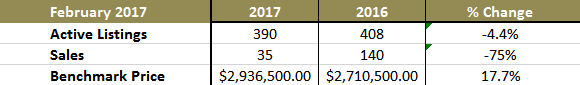

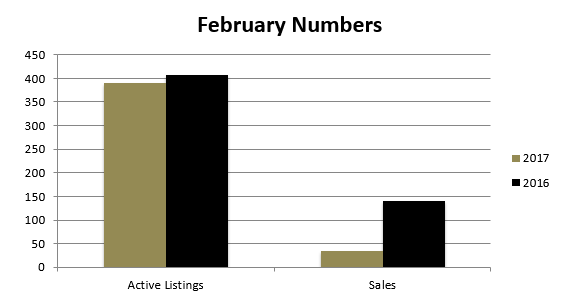

· Market Numbers ·

This month we have seen the overall listing count hold relatively steady with the sales volume compared to last year at this time down dramatically.

It is important to note however that the amount of sales in February is the most since the announcement of the foreign buyers tax last August. Each and every month the open market is adjusting and making the necessary corrections, mainly to the listing price of homes. The MLS Benchmark sale price is up close to 20% compared to that of last year. The sale prices do not appear to be taking a significant hit, however the list prices that were long overdue for a correction anyway are seeing a large decrease.

· Example ·

A specific example of the MLS Benchmark price being accurate showing an increase in sale prices over that of last year is shown in the sale of 6194 Eastmont Drive. This home sold recently for $1,789,000, close to a 30% increase over what it did roughly 1.5 years ago thus showing that sale prices are still over and above what they once were. I would argue that this massive rate of increase year after year is un-sustainable however the current price levels are sustainable given the amount of demand experienced in certain sections.

· Dollar Volume On The Rise ·

What people should be talking about is the trend that the market is taking since August, not the individual statistics of each month. The doom and gloom approach is only for those who have been stuck in their ways. The fact is, the total dollar volume of sales in West Vancouver has been steadily increasing over the last several months.

Are we going to get back to the enormous volumes that we saw last year? That is anyone’s guess however I would argue that we are in for a steady increase in sales volume given the strength of specific sections of the market. The “ripple effect” generated from areas of the market will make its way into all corners; time is all that is required.

· Principle Residency Reporting ·

The CRA has now decided to crack down on the requirements for reporting your disposition of a principle residence as of January 1, 2016. When you sell your principle residence you must now declare the sale on your yearly T2091 tax form. Furthermore, to calculate the amount exempted from tax, you must apply the formula as follows.

{(1+A)/B} x Realized Gain

A: The number of years where the house was a principle residence and the owner was a resident of Canada

B: The number of years of ownership

As always, my team and I are here to answer any questions that you may have. Please do not hesitate to contact us.

Contact Jamie Harper