Changing Market Dynamics · A Chance to Capitalize

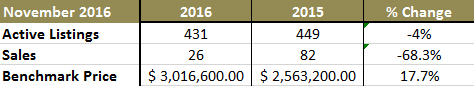

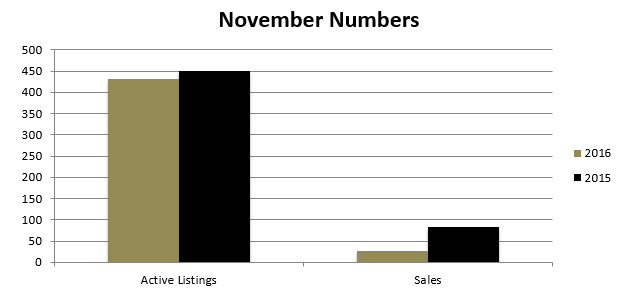

The question on everyone’s mind still looms as months pass since the market was sent into turmoil due to the government’s new regulations. Each and every day, we are seeing promising home sales, just not to the same volume of what we are used to. Home sale values seem to be holding relatively constant with the MLS Benchmark price hovering just above the $3-million mark.

As I have said, the list prices are the main factor that have needed a major adjustment, not the sale prices. I believe that the lack of sales volume can be attributed to the exorbitant listing prices in the market. Homes that are priced well are selling at average, or better than average lengths on the market.

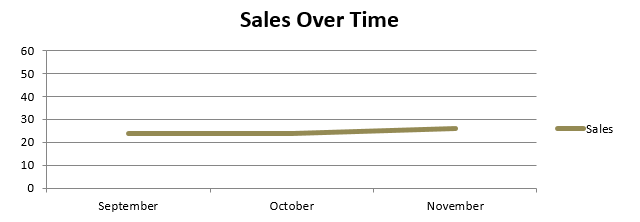

This month we have seen the overall active listing count slightly decrease over that of November 2015 as well as a decrease from last month. The most important factor however is the amount of sales as this is directly affected by consumer’s confidence in the market. There has been a dramatic drop in the number of sales over last year at this time, however the amount of sales have been holding relatively steady each month since the introduction of the foreign buyers tax.

I believe that the sale numbers remaining constant shows that there is a large portion of consumers who have correctly identified these market conditions as an opportunity to acquire real estate at fair market values. Again, the hold pattern that some consumers have exemplified as of recent can not be considered to be the correct approach and those who are willing to intelligently break that pattern have the opportunity to realize exceptional returns due to the reduced competition in the market.

Case Study

Sale prices are holding relatively steady and properties priced at their true fair market value are selling quickly.

Example

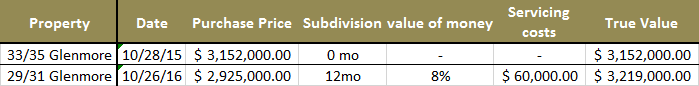

This property sold at the peak of the market, October 28, 2015.

It was two properties sold together that had previously been subdivided, all servicing costs had been paid by the Seller.

Sale Price: $3,152,000

29/31 Glenmore Drive

Sold October 26, 2016 at the bottom of the market. This property, in addition to the list price contained subdivision risk as it requires subdivision, servicing costs to be paid by the Buyer and an immense amount of time and effort to complete the subdivision.

Sale Price: $2,925,000

On its face, it appears that 29/31 Glenmore sold at a significant discount due to the deflated market conditions at the time. This in fact is not true. In actuality, 29/31 Glenmore sold at a significant premium over the latter even in these uncertain times.

Case Study · Continued …

33/35 Glenmore sold at the peak of the market for $67,000 less than 29/31 Glenmore. This is taking into account the servicing costs and opportunity costs of holding the property during the subdivision process. It is important to note that an 8% opportunity cost is also very conservative. I have not priced subdivision risk into the example, however it should be noted that there is a significant cost associated with this.

Both properties are almost identical to each other and are near perfect comparisons. You would expect that the property that sold during much better market conditions would have sold for significantly more however the property that sold during a depressed market actually sold for a higher price, all things considered.

This example, along with numerous other cases, confirms my notion that sale prices have remained relatively constant throughout the last several months; it is the list prices that have seen the major correction, and rightly so. This example also proves that there are Buyer’s who are ready, willing and able to purchase property if they believe it has the correct valuation associated with the purchase. The Buyer who bought 29/31 Glenmore has realized that development opportunities such as this are rare and that the projects true value ultimately has not been largely adversely affected as of recent. The Buyer has intelligently chosen to capitalize on these market conditions to purchase the property when many others would chose not to.

Advice for Sellers

It is imperative that your home be priced according to its long-term fair market value. The overall lack of sales compared to the amount of active listings on the market allow for Buyers to pick and choose which homes they want to purchase. The market dynamics have changed; we are in a market where the Buyers hold the power. Sellers no longer have the luxury of their homes being considered a rare commodity. It is important that the Buyers realize that your home is priced well and is at its accurate value. Be sure to work with an agent that is able to provide the potential purchasers with an in-depth market analysis as to why the price is justified. In todays market, far too many have set their prices far above the current market and therefore are experiencing un-satisfactory results.

Advice for Buyers

Now is the time where great deals can be had. Those who are willing to break the current “wait and see” approach are reaping the rewards. Reduced competition and subsequently more time for rational analysis allow Buyers who are willing to purchase with an edge over previous. Be sure that you are working with a proactive agent who understands that todays changing market dynamics can open possibilities that were not previously available to you.

Contact Jamie Harper