West Vancouver’s Real Estate Market: What Is Really Going on?

With the flurry of recent chatter about Vancouver’s housing market it is hard to derive ones own opinion on what is truly going on; here is my take on September’s real estate market. On August 2nd, the government announced and implemented a shocking 15% tax on foreign buyers and thus the real estate market was essentially thrown further into a state of confusion. Therefore, September’s home sale numbers have, of course, been affected over that of the previous years (2015). In addition, prior to the August 2nd tax implementation the market was showing signs of a slow down, which was largely in part due to Sellers unrealistic price expectations. That is, numerous homes were grossly overpriced far in excess of what their true valuation should have been. These overpriced homes, for obvious reasons, did not sell and thus created a sense of a market going stale; whereas in reality, homes that were priced right were still receiving a large amount of interest from proactive Buyers.

Making Sense Of It All

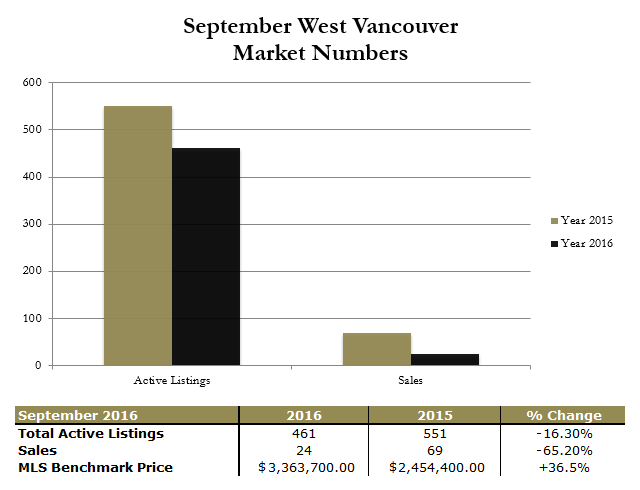

The main message here is that across the board detached home sales are down and active listings are down. In the month of September 2016 we had 24 sales reported, whereas the year before we had nearly triple that amount at 69.

Not only are the reported detached home sales down, but also the active listing count has decreased to 461 from 551.

It is important to note that the decrease in active listings is not proportional to the decrease in sales; that is the percentage drop in active listings is not equal to the percentage drop in sales. The percentage drop in sales is much greater, and arguably a much more significant factor than that of active listings.

Where To Go From Here?

Moving forward, I believe that the best course of action would be to proceed with both positivity and caution. The rapid increase in pricing that we have seen over the last year, a massive 36.5% increase in the MLS Benchmark Price, is not a sustainable growth rate. Regardless of the knee-jerk reaction made by the government by ways of taxing foreign buyers, this growth rate could not have been maintained at its astronomical level. Had the government not intervened, the free market would likely have corrected itself, it just would have happened in a more gradual and manageable way.

In West Vancouver there are still numerous notable sales occurring each and every day, just not to the same volume as it once was. More than anything I would attribute the lower amount of sales to that of uncertainty in the market, Buyers are taking the “wait and see approach” rather than actively pushing to buy. This can leave the door open for those who are willing to break the hold pattern to proceed with caution and logical thinking.

Advice as a Seller

While there are still large amounts of active listings for sale, many of these listings can arguably be said to be overpriced and therefore, as previously stated, undesirable. Many Sellers have impractical expectations on the sale price of their home, mostly due to the thought that the un-realistic rate of increase that has been witnessed over the past year will continue to climb. If many of these homes were priced according to their true, “long-term value”, then I would be confident to say that the sale count would increase dramatically. It is also important to note that listings that begin with pricing that is too high can become stale and as a consequence become hard to sell. I am of the opinion that if a product is priced right, it will always be in demand.

Advice as a Buyer

As previously stated, sales for the month of September are down. It is said that once the ratio of Sales to Active Listings decreases below roughly 15%, we are in a buyers market. This ratio has fallen to 5.2% for detached homes. The deal that you have been waiting for could now have a very strong possibility of being realized if you are working with a proactive real estate agent. Proceeding with both positivity and caution could bring immense rewards over the long-term outlook.

Putting it all Together

Some say we are on the verge of a bubble bursting, some say that we are in a mild correctional period and some say that what we are seeing is a normal cyclic business cycle. Call it whatever you like but the facts are clear: sales are down, listings are down, and people’s confidence in the market has been shaken. Now could be the time to take advantage of a changing market in order to realize economic benefits that could not have occurred in the past.

As always, my team and I are ready, willing and able to answer any questions that you may have on today’s ever-changing market.

Contact Jamie Harper